Banking is an integral part of our everyday lives. We interact with various banking procedures and systems on a daily basis. In this article, we will delve into the Alaska USA routing number. Whether you are an existing client or contemplating opening an account with Alaska USA, understanding the routing number is critical for smooth and hassle-free transactions.

Discover the Alaska USA routing number you need for reliable financial transactions. Whether you’re establishing direct deposits, executing electronic payments, or transferring funds, possessing the correct routing number is essential. Learn how to locate and use the Alaska USA routing number to ensure your money reaches its destination accurately and efficiently.

Are you a Alaska USA Federal Credit Union account holder? Find the correct routing number to ensure your domestic or international wire transfer accurately reaches its destination.

Alaska USA Federal Credit Union routing numbers

| Routing Number | Bank | Address** | State | Zip |

|---|---|---|---|---|

| 325272021 | ALASKA USA FCU | P.O. BOX 196613 ANCHORAGE | Alaska | 99519 |

| 325272199 | ALASKA USA FCU (EIELSON FCU) | PO BOX 196613 ANCHORAGE | Alaska | 99519 |

| 322270796 | ALASKA USA FEDERAL CREDIT UNION | PO BOX 196613 ANCHORAGE | Alaska | 99519 |

| 322283592 | ALASKA USA FEDERAL CREDIT UNION | PO BOX 196613 ANCHORAGE | Alaska | 99519 |

| 325081623 | ALASKA USA FEDERAL CREDIT UNION | PO BOX 196613 ANCHORAGE | Alaska | 99519 |

What is the Alaska USA Routing Number?

The routing number for all branches of Alaska USA Federal Credit Union is 325272021.

A routing number is a unique nine-digit code assigned to a financial institution by the American Bankers Association (ABA). Routing number serves as an identifier for banks and credit unions, allowing them to facilitate secure and accurate transactions.

Every bank in the United States has its own routing number, and it is used for various purposes, such as processing wire transfers, direct deposits, electronic payments, and check processing. Once you understand the routing number, transferring money become like a left-hand job for you.

The Alaska USA routing number plays an important role in ensuring the seamless and error less flow of funds between different accounts and financial institutions. To make every transaction whether you make online transactions, or transfer money to others having the correct routing number is essential to avoid delays and errors with all transactions.

The Alaska USA Routing Number and Online Banking:

In the current Internet era, things are moving quickly, and with this, the banking system is also shifting towards online banking. Online banking has now become an integral part of our lives. In our daily routine, we use it to send or receive money from others.

To make effortless and error-free transactions, we should be well-informed about online banking, and the Alaska USA routing number plays a crucial role in online banking.

Alaska USA understands your needs and has seamlessly integrated its routing number into its online banking platform. With just a few simple clicks, you can access your routing number and initiate a wide range of transactions without encountering any errors.

How to Find Your Alaska USA Routing Number:

Every USA bank has its own routing number, so finding the right Alaska USA routing number is important to make error less transactions. One can easily find the Alaska USA routing number on

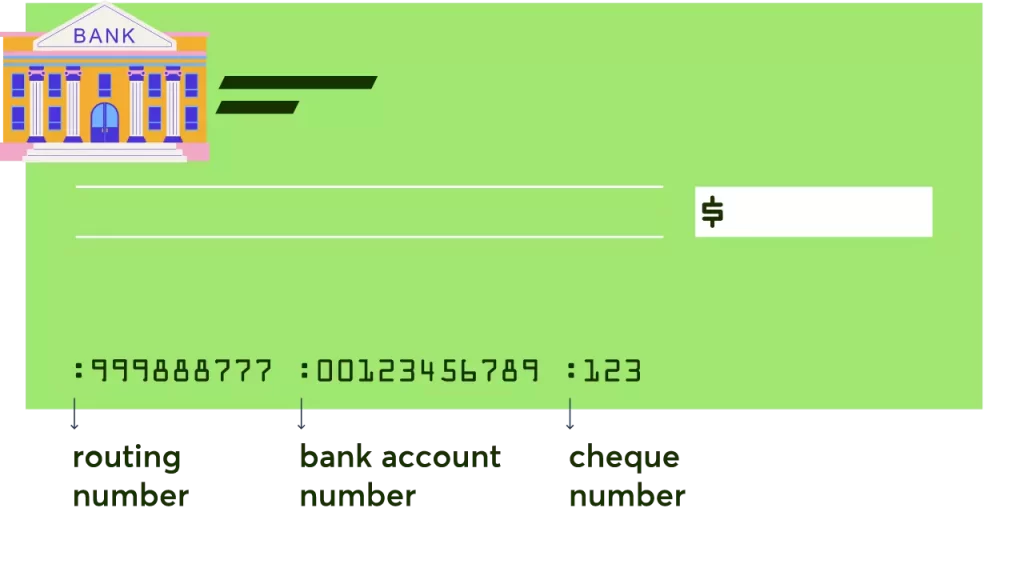

1. Checkbook: This is the easiest way to find out the Alaska USA routing number. If you have a check book, your routing number is printed on the bottom left corner of your checks. It is the nine-digit number appearing before your account number.

2. Online Banking: If you don’t have a check-book then you can find the Alaska USA routing number just by logging in to your Alaska USA online banking account, and you can easily access your routing number under the account information section.

3. Account Statements: An account statement is also one of the ways to find out your Alaska USA routing number to make error less online transactions. Your routing number is often included on your account statements, making it readily available for reference.

4. Official Website: To access Alaska USA routing numbers from everywhere, visit the Alaska USA official website, where you can find the routing number listed in the FAQs or account-related information.

Apart from this, you can reach out to the bank’s customer service for assistance to find the correct Alaska USA routing number. Remember without the correct Alaska USA routing number you can lose your hard-earned money.

Ensuring Accuracy for Secure Transactions:

Ensuring correct details when making online transactions is the key to error-free transactions. When engaging in online banking, it’s crucial to verify the Alaska USA routing number for precise electronic transactions. Mistakes can result in issues such as funds being sent to the wrong account or transaction rejections.

Before making a transaction, it is crucial to always verify the Alaska USA routing number. You can achieve this by contacting your bank or visiting its official website. By doing so, you can avoid any potential issues that may arise.

The Structure of Alaska USA Routing Number:

The Alaska USA routing number is a nine-digit code established by the American Bankers Association (ABA) in a specific format. This nine-digit code encodes crucial information about the transaction’s origin and destination. To facilitate error-free and smooth transactions, understanding the routing number format can be beneficial for both customers and banking professionals.

- The Alaska USA routing number has a structured code format of 4-4-1.

- In this format the first four digits represent the Federal Reserve routing symbol, indicating the Federal Reserve Bank responsible for processing electronic transactions for the bank.

- Following the next four digits identify the specific financial institution, in this case, Alaska USA Bank.

- In this structure, the last digit, known as the check digit, serves as a checksum for error detection during electronic transactions.

Discover the Benefits of Using the Correct Alaska USA Routing Number:

Online banking is a crucial method for effortlessly transferring money to anyone, regardless of location, while maintaining security. To ensure smooth and accurate transactions, it’s essential to use the correct Alaska USA Routing Number. An incorrect Alaska USA routing number can result in financial losses or erroneous transactions. To avoid such problems, it’s advisable to double-check the routing number before initiating any transaction.

Using the correct Alaska USA routing number can offer many benefits to account holders.

1. Faster Transactions: We all rely on online banking systems for swift transactions, and by utilizing the correct routing number, you can reduce processing times for various transactions. Whether you’re making a payment, receiving funds, or initiating a wire transfer, the proper routing number guarantees that the transaction reaches its destination without errors.

2. Avoiding Fees and Penalties: To avoid penalties or return fees, it is crucial to use the correct Alaska USA routing number. Utilizing an incorrect routing number can lead to unsuccessful transactions or returned payments, which may result in potential charges and penalties. Simply by verifying and using the correct routing number, you can prevent unnecessary fees and ensure a positive banking experience.

3. Secure and Reliable Transactions: We all understand that every technology has its drawbacks, and online banking is no exception. Therefore, when conducting online transactions, using the correct Alaska USA routing number can facilitate secure transfers between accounts, minimizing the risk of fraud or unauthorized access.

4. Seamless International Transactions: Online banking simplifies international transactions for both individuals and businesses. For those involved in international business or those needing to send money to their loved ones abroad, having the correct Alaska USA routing number for international wire transfers is essential. Using the accurate Alaska USA routing numbers ensures that your money is securely transferred between accounts, minimizing the risk of fraud or unauthorized access.

Unravelling the Impact of Alaska USA Routing Number on Your Financial Transactions!

To make all online banking transactions smooth and error less The Alaska USA routing number plays a pivotal role. In this section, we will find out how the Alaska USA routing number impacts different aspects of your banking experience:

1. Direct Deposits: For all employees, direct deposits are the preferred method of receiving their paychecks. Employees can get their salary direct into their bank account By providing their employer with the correct Alaska USA routing number and account number. This not only saves time but also eliminates the risk of losing or misplacing physical checks.

2. Online Bill Payments: Online bill pay is a revolution in the banking system that changes the way how we manage our finances. With the Alaska USA routing number, you can easily set up payments through your online banking platform. Just by using the correct Alaska USA routing number, you can pay all kinds of bills whether it’s utility bills, mortgage payments, or credit card dues accurately and on time.

3. Domestic Wire Transfers: Are you worried about transferring money quickly to another account within the United States? Then domestic wire transfers are the solution for you. Just by inputting the right Alaska USA routing number and the recipient’s account number, you can initiate a same-day transfer, ensuring that your funds reach the destination promptly.

4. International Wire Transfers: For making international transactions, having the correct routing number is vital. International wire transfers require a specific routing number, known as the SWIFT code or BIC (Bank Identifier Code). The Alaska USA provides you with the required routing number for hassle-free international money transfers, allowing you to do business globally or send funds to your known one.

5. ACH Transfers: To make fund transfer between different accounts, Automated Clearing House (ACH) transfers are a secure and efficient method. Whether it’s setting up recurring payments or transferring money to external accounts, the Alaska USA routing number is a crucial element in ensuring the accuracy and success of ACH transactions.

6. Check Processing: Even in today’s digital world, when we are adopting the new age technology by hand to hand checks is still remain a common form of payment for various transactions. When issuing or depositing a check, the Alaska USA routing number is essential to ensure that the funds are correctly routed to the intended financial institution.

Tips for Error-Free Routing Number Usage

To make all online transactions seamless and avoid any potential hiccups in your financial transactions, always keep in mind the following tips:

1. Double-Check the Routing Number: Before making any online transaction always double-check the Alaska USA routing number to avoid any problems. Even a single-digit error can lead to delays or misdirected your money.

2. Verify International Wire Transfer Details: If you are initiating any international wire transaction, verify the recipient bank’s information, including their SWIFT code or BIC, to ensure a successful transaction.

3. Contact Customer Support for Assistance: Alaska USA’s customer support is always there to help you. If you are ever unsure about the routing number or need clarification on any banking-related matter, do not hesitate to reach out to Alaska USA’s customer support. They are there to assist and help you to make error-less transactions.

Alaska USA routing number safety:

To ensure an effortless and error less banking experience, Alaska USA always takes the security of its routing number seriously. Alaska USA implements strict security measures to protect customer data and privacy. These measures include encryption protocols, firewalls, and regular security audits to safeguard against potential threats. They always ensure to prevent unauthorised access to customer accounts.

Alaska USA also advised customers to not share their routing numbers with entrusted sources. Alaska USA advised to share the routing number with reputable institutions or individuals they trust for legitimate financial transactions. Customers can protect their financial information and ensure transaction safety by being careful and following Alaska USA’s routing number guidelines.

Unlocking the Full Potential of Alaska USA’s Routing Number:

Online banking has great potential and benefits. Online banking has many advantages and opportunities. In this section, we will discover how to effectively utilize the Alaska USA routing number for our everyday banking needs.

1. Streamline Your Online Banking: Having the Alaska USA routing number at your fingertips allows you to streamline your online banking activities. Set up automatic bill payments, schedule fund transfers, and manage your finances effortlessly using the correct routing number. Embrace the convenience of online banking and save valuable time for the things that truly matter for Alaska USA.

2. Stay Informed with Account Alerts: Stay alert with the Alaska USA account alerts banking system. It helps you to set up alerts for incoming deposits, low balances, or any suspicious activity. These notifications are for helping you to ensure that you’re always in control of your money.

3. Simplify Payroll Processes: If you’re an employer, the Alaska USA routing number can simplify your payroll processes. Use the correct Alaska USA routing number to pay your employees accurately and on time through direct deposits.

4. Plan for a Secure Future: Financial planning is the one most important thing which everyone should do without any second thoughts. Utilise the Alaska USA routing number to set up automatic savings transfers, contributing to your savings or retirement accounts consistently. You can secure your future just by using the Alaska USA routing number in the correct way.

5. Make Informed Decisions: Accessing your Alaska USA routing number allows you to make informed decisions when it comes to your banking needs. Alaska USA routing number helps you to get a deeper understanding of your finances. Whether you’re considering a loan, opening a new account, or refinancing, knowing the correct routing number ensures that you have accurate information at your disposal.

Alaska USA Routing Numbers in Different Branches:

Whether you are in Anchorage, Fairbanks, or Seattle, the Alaska USA Routing Number remains the same for all branches. It ensures uniformity and consistency across the bank’s operations, making transactions convenient for customers no matter their location.

How to Remember Your Alaska USA Routing Number?

Remembering your Alaska USA routing number can be challenging, especially if you have multiple accounts. You can take the following steps to make the process easier:

1. Save It in Your Phone: We all have a phone and keep it with us 24*7. You can store your Alaska USA routing number in your phone’s notes or contacts for quick access when needed.

2. Write It Down: To keep it safe write down your routing number and keep it in a safe and easily accessible place, such as your wallet or a secure drawer at home.

3. Use Online Banking: Take advantage of Alaska USA’s online banking platform, which will save your routing number and make it readily available whenever you log in.

Top & All The Banks by Count of US ACH Routing Numbers-

| S. NO | Bank Name | No Of Routing Numbers | More Information |

|---|---|---|---|

| 1 | AMERIS BANK | 23 | Learn More |

| 2 | BANCO POPULAR | 25 | Learn More |

| 3 | BANCORP SOUTH | 15 | Learn More |

| 4 | BANCORPSOUTH | 21 | Learn More |

| 5 | BANCORPSOUTH BANK | 11 | Learn More |

| 6 | BANK OF AMERICA | 216 | Learn More |

| 7 | BANK OF COMMERCE | 12 | Learn More |

| 8 | BANK OF HOPE | 17 | Learn More |

| 9 | BANK OF NEW YORK MELLON | 20 | Learn More |

| 10 | BANK OF NORTH CAROLINA | 14 | Learn More |

| 11 | BANK OF THE OZARKS | 44 | Learn More |

| 12 | BANK OF THE WEST | 18 | Learn More |

| 13 | BANKPLUS | 11 | Learn More |

| 14 | BANNER BANK | 36 | Learn More |

| 15 | BEAR STATE BANK | 13 | Learn More |

| 16 | BERKSHIRE BANK | 11 | Learn More |

| 17 | BMO HARRIS BANK | 140 | Learn More |

| 18 | BRANCH BANKING & TRUST COMPANY | 39 | Learn More |

| 19 | BUSEY BANK | 12 | Learn More |

| 20 | BYLINE BANK | 14 | Learn More |

| 21 | CADENCE BANK | 14 | Learn More |

| 22 | CAMDEN NATIONAL BANK | 11 | Learn More |

| 23 | CAPITAL BANK CORPORATION | 11 | Learn More |

| 24 | CAPITAL BANK | 38 | Learn More |

| 25 | CAPITAL CITY BANK | 16 | Learn More |

| 26 | CAPITAL ONE | 87 | Learn More |

| 27 | CATHAY BANK | 11 | Learn More |

| 28 | CENTENNIAL BANK | 38 | Learn More |

| 29 | CENTRAL BANK | 43 | Learn More |

| 30 | CHEMICAL BANK | 32 | Learn More |

| 31 | CITIBANK | 56 | Learn More |

| 32 | CITIBANK WEST | 12 | Learn More |

| 33 | CITIZENS BANK | 96 | Learn More |

| 34 | CITIZENS BUSINESS BANK | 22 | Learn More |

| 35 | CITIZENS NATIONAL BANK | 27 | Learn More |

| 36 | CITIZENS STATE BANK | 53 | Learn More |

| 37 | CITY NATIONAL BANK | 21 | Learn More |

| 38 | COLUMBIA STATE BANK | 21 | Learn More |

| 39 | COMERICA BANK | 13 | Learn More |

| 40 | COMMERCE BANK | 21 | Learn More |

| 41 | COMMERCIAL BANK | 24 | Learn More |

| 42 | COMMUNITY BANK | 77 | Learn More |

| 43 | COMMUNITY FIRST BANK | 20 | Learn More |

| 44 | COMMUNITY NATIONAL BANK | 13 | Learn More |

| 45 | COMMUNITY STATE BANK | 18 | Learn More |

| 46 | COMPASS BANK | 49 | Learn More |

| 47 | CORNERSTONE BANK | 19 | Learn More |

| 48 | CREDIT UNION OF SOUTHERN CALIFORNIA | 11 | Learn More |

| 49 | EAST WEST BANK | 23 | Learn More |

| 50 | EASTERN BANK | 19 | Learn More |

| 51 | FARMERS & MERCHANTS BANK | 28 | Learn More |

| 52 | FARMERS BANK | 29 | Learn More |

| 53 | FARMERS STATE BANK | 66 | Learn More |

| 54 | FEDERAL RESERVE BANK | 20 | Learn More |

| 55 | FIDELITY BANK | 15 | Learn More |

| 56 | FIFTH THIRD BANK | 75 | Learn More |

| 57 | FINANCIAL PARTNERS CREDIT UNION | 11 | Learn More |

| 58 | FIRST BANK | 106 | Learn More |

| 59 | FIRST BANK & TRUST | 27 | Learn More |

| 60 | FIRST CITIZENS BANK & TRUST COMPANY | 18 | Learn More |

| 61 | FIRST COMMUNITY BANK | 46 | Learn More |

| 62 | FIRST FIDELITY BANK | 13 | Learn More |

| 63 | FIRST FINANCIAL BANK | 57 | Learn More |

| 64 | FIRST MERCHANTS BANK | 13 | Learn More |

| 65 | FIRST MIDWEST BANK | 25 | Learn More |

| 66 | FIRST NATIONAL BANK | 348 | Learn More |

| 67 | FIRST NATIONAL BANK OF OMAHA | 15 | Learn More |

| 68 | FIRST NATIONAL BANK OF PENNSYLVANIA | 48 | Learn More |

| 69 | FIRST SAVINGS BANK | 11 | Learn More |

| 70 | FIRST SECURITY BANK | 29 | Learn More |

| 71 | FIRST STATE BANK | 154 | Learn More |

| 72 | FIRST TENNESSEE BANK | 22 | Learn More |

| 73 | FIRSTBANK | 57 | Learn More |

| 74 | FRANDSEN BANK & TRUST | 10 | Learn More |

| 75 | GERMAN AMERICAN BANCORP | 11 | Learn More |

| 76 | GLACIER BANK | 37 | Learn More |

| 77 | GOLDMAN SACHS BANK USA | 1 | Learn More |

| 78 | GRANDPOINT BANK | 10 | Learn More |

| 79 | GREAT LAKES CREDIT UNION | 12 | Learn More |

| 80 | GREAT SOUTHERN BANK | 13 | Learn More |

| 81 | GREAT WESTERN BANK | 23 | Learn More |

| 82 | HERITAGE BANK | 35 | Learn More |

| 83 | HORIZON CREDIT UNION | 12 | Learn More |

| 84 | HSBC BANK | 29 | Learn More |

| 85 | HUNTINGTON NATIONAL BANK | 23 | Learn More |

| 86 | IBERIABANK | 43 | Learn More |

| 87 | INDEPENDENT BANK | 16 | Learn More |

| 88 | INTERBANK | 18 | Learn More |

| 89 | INTERNATIONAL BANK OF COMMERCE | 23 | Learn More |

| 90 | JPMORGAN CHASE | 62 | Learn More |

| 91 | KEY BANK | 33 | Learn More |

| 92 | KEYBANK | 26 | Learn More |

| 93 | LIBERTY BANK | 19 | Learn More |

| 94 | M & T BANK | 31 | Learn More |

| 95 | M B FINANCIAL BANK | 17 | Learn More |

| 96 | MAINSOURCE BANK | 15 | Learn More |

| 97 | MUFG UNION BANK | 25 | Learn More |

| 98 | NBH BANK | 18 | Learn More |

| 99 | NEW YORK COMMUNITY BANK | 21 | Learn More |

| 100 | PACIFIC WESTERN BANK | 27 | Learn More |

| 101 | PARK NATIONAL BANK | 15 | Learn More |

| 102 | PENTAGON FEDERAL CREDIT UNION | 11 | Learn More |

| 103 | PEOPLES BANK | 71 | Learn More |

| 104 | PEOPLES STATE BANK | 25 | Learn More |

| 105 | PINNACLE BANK | 24 | Learn More |

| 106 | PIONEER BANK, SSB | 10 | Learn More |

| 107 | PNC BANK INC BALTIMORE | 19 | Learn More |

| 108 | PNC BANK | 146 | Learn More |

| 109 | PROSPERITY BANK | 78 | Learn More |

| 110 | REGIONS BANK | 42 | Learn More |

| 111 | RENASANT BANK | 48 | Learn More |

| 112 | S & T BANK | 13 | Learn More |

| 113 | SANTANDER BANK | 28 | Learn More |

| 114 | SECURITY BANK | 32 | Learn More |

| 115 | SECURITY STATE BANK | 34 | Learn More |

| 116 | SELF-HELP CREDIT UNION | 12 | Learn More |

| 117 | SIMMONS FIRST NATIONAL BANK | 12 | Learn More |

| 118 | SIMMONS FIRST NATL BK | 16 | Learn More |

| 119 | SOUTH STATE BANK | 29 | Learn More |

| 120 | STATE BANK AND TRUST COMPANY | 16 | Learn More |

| 121 | STERLING NATIONAL BANK | 10 | Learn More |

| 122 | STONEGATE BANK | 13 | Learn More |

| 123 | TD BANK | 49 | Learn More |

| 124 | THE HUNTINGTON NATIONAL BANK | 22 | Learn More |

| 125 | THE PEOPLES BANK | 14 | Learn More |

| 126 | TRUSTMARK NATIONAL BANK | 19 | Learn More |

| 127 | UMB | 23 | Learn More |

| 128 | UMPQUA BANK | 32 | Learn More |

| 129 | UNIFY FINANCIAL FEDERAL CREDIT UNION | 11 | Learn More |

| 130 | UNION BANK & TRUST | 21 | Learn More |

| 131 | UNION STATE BANK | 18 | Learn More |

| 132 | UNITED BANK | 62 | Learn More |

| 133 | UNITED BANK & CAPITAL TRUST COMPANY | 10 | Learn More |

| 134 | UNITED COMMUNITY BANK | 36 | Learn More |

| 135 | US BANK | 60 | Learn More |

| 136 | USALLIANCE FEDERAL CREDIT UNION | 13 | Learn More |

| 137 | VALLEY NATIONAL BANK | 37 | Learn More |

| 138 | WEBSTER BANK | 22 | Learn More |

| 139 | WELLS FARGO BANK | 132 | Learn More |

| 140 | WESBANCO BANK INC | 11 | Learn More |

| 141 | WHITNEY BANK | 14 | Learn More |

| 142 | XENITH BANK | 10 | Learn More |

Final Thoughts:

Understanding online banking and using it safely is essential in the world of digital banking. The Alaska USA Routing Number plays a pivotal role in online banking. This number enables us to conduct smooth and mistake-free banking transactions.

The Alaska USA routing number is the cornerstone of any online banking operations in the USA. The Alaska USA Routing Number is a nine-digit code that gives freedom to the user to make secure online transactions. Alongside the banking experience Alaska USA Bank’s commitment to the safety and security of customers’ data and privacy.

Using the right routing number ensures safe and easy banking, allowing you to fully benefit from the bank’s services.

Sources

Disclaimer

The information provided in this guide is intended for general informational purposes only. While every effort has been made to ensure the accuracy of the information, banking policies and fees may be subject to change. Users are strongly advised to verify specific details and consult with their banks should they have any questions or concerns.Instarem assumes no responsibility for any errors or omissions in this guide, or for any actions taken based on the information provided herein